So you want to start a new business? How do you fund it?

You can take many funding routes, each with its benefits and drawbacks. Choosing the right one is tough, especially if you’re a first-time entrepreneur.

Understanding your funding options is a great place to start. This article has broken down the five most popular ways to fund your business.

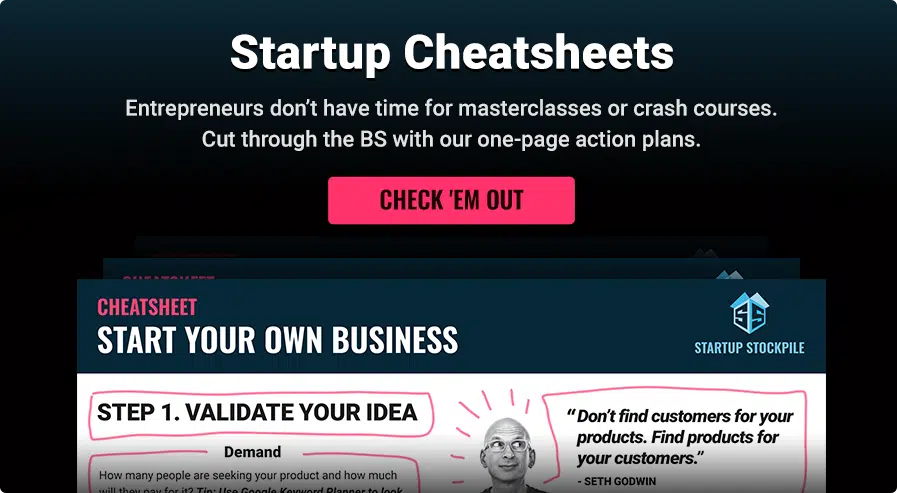

Consider this your startup funding cheatsheet:

1. Self-Funding Your Business

You could use your savings or other personal assets to keep your business running. Although it may sound daunting, entrepreneurs often sell the property they have or take out mortgages to fund their businesses.

This option is called “bootstrapping”.

Once the business grows, you continually reinvest some revenue to support the development. This gives you a steady growth rate and a business that funds itself immediately.

When it comes to the company’s management, it is entirely in your hands, as you are its sole owner. On the other hand, it may take a considerable amount of time to fully develop the business since the funds at your disposal will be limited, and you may be forced to make some sacrifices in terms of your lifestyle and money-spending habits until your company starts generating considerable profits.

Bootstrapping your business is no small investment and carries the risk of losing a lot. If the business succeeds – you reap all the benefits.

If it doesn’t – you lose everything you invested.

2. Seed Money from Friends & Family

Getting your friends and family to invest in your business can either be the best decision in your career as an entrepreneur or the exact opposite. The people you hold closest can usually provide you with equity or debt funding at very favorable terms, if not give you some money as a gift to help you realize your dreams.

Reaching an agreement with them should be pretty easy, and they will probably be patient in waiting for the investment to start giving returns. However, mixing business with personal relationships shouldn’t be taken lightly.

Even though your business idea may be flawless in your mind, it can still fail, leaving you to deal with disappointed friends and marred family relationships.

If you opt for this solution, ensure you and your partners understand all associated risks and are comfortable with the consequences of the business failing.

3. Taking Out a Loan

Loaning the money you need to put your idea into practice from banks, other financial institutions, or organizations is always an option.

If you’re uncomfortable funding your business or asking your friends and family for investment – this might be your route.

With the many lenders offering different loan terms, you are bound to find one that suits your needs.

Generally, as traditional lending institutions, banks require you to secure the loan with your assets. On the other hand, you can easily find lenders willing to provide you with unsecured loans under transparent terms.

Funding your business through a personal loan allows you to retain all of the equity and remain independent in the management of your company. You should be in good shape if you’re smart and manage your business expenses well.

However, before taking out a loan, you should try to anticipate the future cash flow of your business and assess whether you can make regular payments. And keep in mind that you will have to repay the loan whether your business thrives or fails.

With that said, investing in good accounting software to keep your startup on track would be a smart move.

4. Finding Investors

If your business idea has the potential to generate high returns in a short time, investors could find it very attractive.

With the right business model and plan, approaching angel investors or venture capitalists to invest in your business may be your best option.

Angel and venture capitalists are professional investors willing to invest money in companies in exchange for equity. Their M.O. is to invest smart, seek liquidation at the right time, and make a large profit.

Investments from angel investors and venture capitalists will make large amounts of money available to you, along with sound advice from experienced businessmen and other benefits, such as new connections.

This could be an ideal solution if you are not looking to start a family business since you will not completely control your company, as the investors will look for a liquidity event to collect the return on their investment.

Here are some resources you should check out:

5. Applying for Grants

Getting a university or government grant to develop your product is the best option to fund a project, especially if it requires extensive research and development.

In addition to not having to pay any money back, the simple fact that the government is funding your idea provides your startup with instant credibility among your customers and other potential investors.

Unfortunately, applying for grants, it’s not that simple.

Typically, grants are only available for certain technical ideas in fields where the government seeks to encourage development. Also, applying for a grant and providing all the necessary documentation to meet the set criteria is tedious.

And even if you qualify for the grant, the government may set restrictions on how to use the funds and what you can do with the product you develop. Still, if your idea for a project is eligible for a grant, you should pursue this option.

Here are a few resources to check out:

- Grants.gov – comprehensive database of grants

- U.S. Small Business Administration – helps you find relevant grants

- SBIR.gov – grants for technology & scientific research

- Challenge.gov – lists government grant competitions

- GrantWatch.com – lists grants for small businesses

6. Use a Crowdfunding Site

If your business does something never before, you might consider using a crowdfunding site like Kickstarter or Indiegogo. Sites like these allow you to take pre-orders as funding you can use to create your products and launch your business.

But before you jump into the world of crowdfunding, there are some things you should know.

7. Apply to Accelerators

Like investors, Accelerators provide you with funding in return for equity in your company. However, they do more than provide funding. They also offer guidance, connections, and a community of entrepreneurs to give you feedback and help you succeed.

Accelerators are competitive programs. It’s hard to get in, but if you do, in many cases, it gives your startup instant street cred among other investors and industry insiders. In business, it’s all about who you know.

Here are some of the best accelerators to check out:

In Conclusion

Before deciding on how to finance your startup, be sure you have researched and familiarize yourself with all the options and how you can combine them to suit your needs.

Starting a new business is both exciting and scary. If you’re a first-time entrepreneur, seeking professional advice might be prudent before you get in over your head.

Editor’s Note: Want more handpicked content that’ll help you build your business? Subscribe to our monthly newsletter.